Life Sciences

Investment Thesis

Industry Structural Change

- COVID-19 has catalyzed a structural change within the life science industry, with exponential increases in new funding provided by both government (NIH) and venture capital. Appreciation for the industry’s importance is leading to an explosive and long-term growth, nearly five times as fast as the overall economy since 2000 (1)

- Advances in technology and expansion in medical research are driving growth in the biotech sector and boosting demand for life science real estate.

Supply Constraints

- As one of the fastest growing segments in the economy, life sciences real estate, and in particular R&D facilities, face significant supply constraints

- Increased funding to life sciences and corresponding demand for more R&D facilities coupled with a highly regulated market for new development have caused absorption to dramatically outpace supply

- Life science submarkets have some of the tightest vacancy rates of any asset class. Vacancy rates in these markets are virtually zero, and any existing vacancy is functionally obsolete

High Barriers To Entry

- Thorough knowledge base of tenant lifecycle for R&D assets required to source and build out versatile spaces that will serve multiple tenants

- Life science is a uniquely complex asset class, with enhanced requirements for mechanical, electrical, and plumbing infrastructure, requiring investors to have significant experience in the space to successfully execute on developments

Recession Resistant Asset Class

- Low correlation with macro-economic trends

- Tenancy is highly “sticky,” as tenants make substantial investments to build out customized spaces and are reluctant to relocate

- Life science submarkets have some of the tightest vacancy rates of any asset class. Vacancy rates in these markets are virtually zero, and any existing vacancy is functionally obsolete

Recession Resistant Asset Class

- Low correlation with macro-economic trends

- Tenancy is highly “sticky,” as tenants make substantial investments to build out customized spaces and are reluctant to relocate

- Demographic tailwind from a growing and aging global population

(1) Source: Cushman & Wakefield

Industry Growth

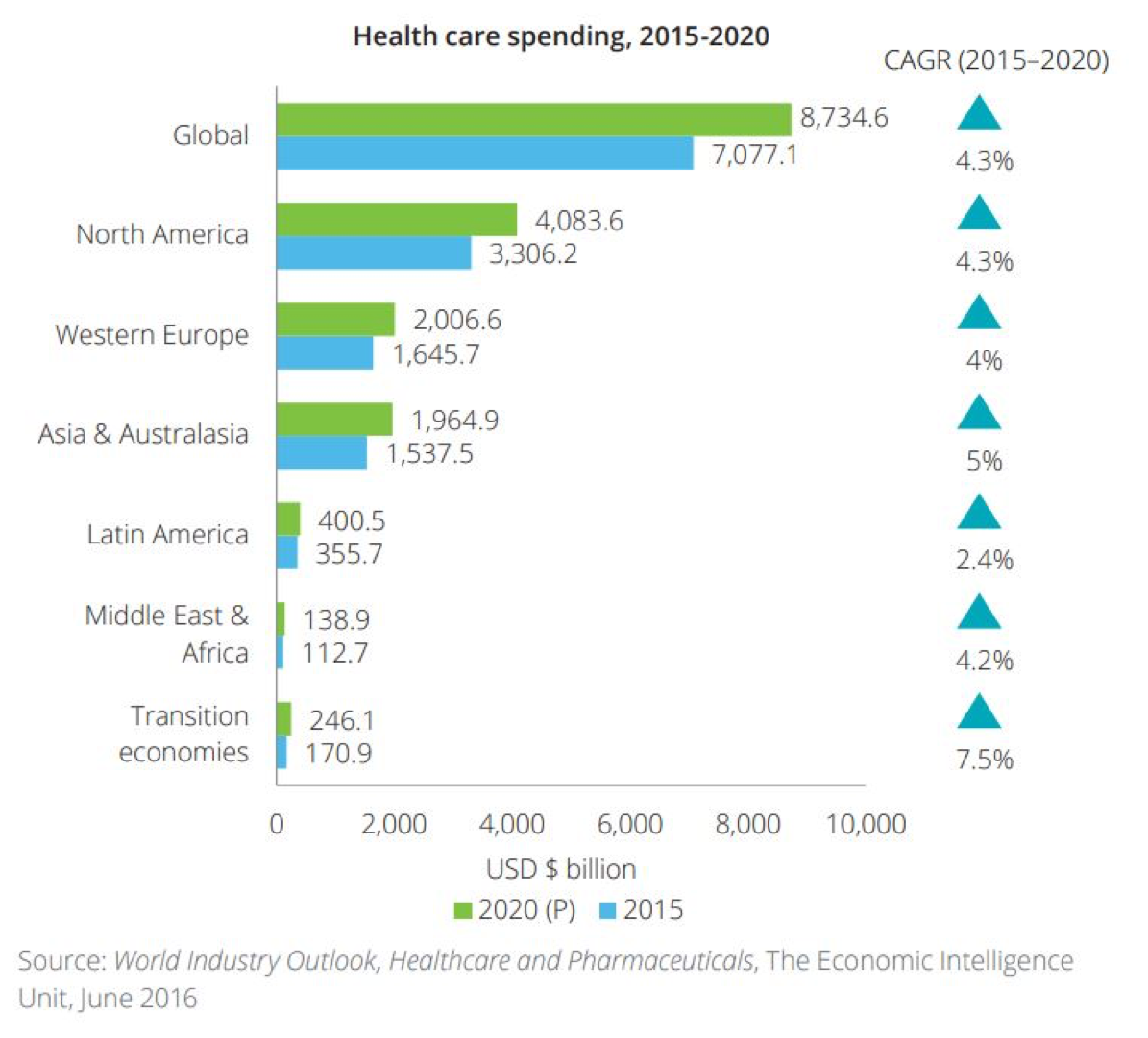

- Life science industry growth is often aligned with global healthcare expenditures, which are expected to rise from $7.7 trillion in 2017 to $10.06 trillion by 2022 at an annual rate of 5.4% (1)

- Revenue in the life science industry is a major economic driver, and has grown at an average of more than 10% each year throughout the past decade, much faster than the rest of the economy (2)

- There are three large sources of funding for the industry—government grants, funding from large pharmaceutical companies and venture capital—helping to stabilize the sector during turbulent cycles

- The life science industry made up 14.6% of the overall share of venture funding in 2018 (2)

- In the past five years, the average life science employee salary has experienced 19.2% growth and the total number of industry institutions has increased by 13.1% (2)

- The life science field will only continue to grow with newfound recognition of its true necessity in a post Covid-19 world.

(1) Source: Deloitte

(2) Source: JLL Life Science

Covid–19 Impact

- The life science sector is at the epicenter of developing tests and treatment for COVID-19, and has benefited from substantial new investment in research and vaccine development. Investment in new labs and facilities will increase as drug development companies continue to draw new funding.

- Lab and medical space can not be replicated in a home office environment, and these workers have been deemed essential, thereby preserving demand for the underlying real estate.

- With international travel and transport constrained, supply chain weakness has been identified in pharmaceutical manufacturing. As a result, manufacturing will partially return to the U.S., facilitating increased demand for these manufacturing assets.

- As the life science sector expands, investment from private equity, institutional lenders and developers will increase.

(1) Source: Cushman & Wakefield